In today’s globalized economy, businesses are no longer confined by borders. As companies expand their operations internationally, they encounter the complexity of dealing with multiple currencies, making Shopify multi currency reporting essential for effective financial management.

This complexity can present significant challenges in financial management, reporting, and strategic decision-making.

However, with the right tools and approaches, multi-currency reporting can be a powerful asset that enhances financial accuracy, transparency, and operational efficiency.

Utilizing Shopify multi currency reporting can greatly enhance financial accuracy and strategic insights.

In this blog, we’ll explore the concept of multi-currency reporting, its importance in global business, and how visual analytics and data visualization techniques can make this complex task more manageable and effective.

Understanding Multi-Currency Reporting

What is Multi-Currency Reporting?

Multi-currency reporting refers to the process of recording, managing, and reporting financial transactions that occur in different currencies.

For businesses operating in multiple countries, this type of reporting is essential for consolidating financial data into a single, cohesive report that reflects the true financial health of the organization.

Unlike single-currency reporting, where all transactions are recorded in one currency, Shopify multi currency reporting requires converting and consolidating data from various currencies, often in real-time, to provide an accurate overview of the business’s financial performance.

The complexity of multi-currency reporting lies in the need to manage exchange rates, ensure consistent currency conversion methods, and integrate financial data from multiple sources.

This process is crucial for businesses that need to comply with international financial reporting standards, manage currency risks, and provide accurate financial information to stakeholders.

Key Components of Multi-Currency Reporting

To effectively implement multi-currency reporting, businesses must focus on several key components:

#1. Exchange Rate Management: Accurate exchange rate management is critical for ensuring that all financial transactions are properly converted into the base currency.

This involves regularly updating exchange rates to reflect current market conditions and applying these rates consistently across all financial transactions.

#2. Currency Conversion Methods: Businesses must decide on the appropriate currency conversion methods, such as using spot rates, forward rates, or average rates. The choice of method can significantly impact financial reporting, especially in terms of how revenue and expenses are recognized.

#3 Financial Consolidation: Consolidating financial data from different regions and currencies is essential for providing a comprehensive view of the business’s financial performance. This process involves integrating data from various sources, such as subsidiaries, branches, and international operations, into a single report.

#4 Real-Time Data: In a fast-paced global market, real-time data is crucial for making informed decisions. Multi-currency reporting tools that provide real-time data enable businesses to monitor currency fluctuations, assess financial performance, and adjust strategies quickly.

#5 Compliance with International Standards: Businesses operating globally must comply with international financial reporting standards, such as IFRS (International Financial Reporting Standards) or GAAP (Generally Accepted Accounting Principles).

Multi-currency reporting tools should support these standards to ensure that financial reports are accurate, consistent, and compliant.

Benefits of Multi-Currency Reporting for Global Businesses

- Enhanced Financial Accuracy and Transparency

One of the most significant advantages of multi-currency reporting is the enhanced financial accuracy it offers. When businesses operate in multiple currencies, it’s easy to encounter discrepancies due to fluctuating exchange rates, inconsistent conversion methods, or manual errors in data entry. Multi-currency reporting systems automate the conversion process, ensuring that all transactions are accurately recorded and reflected in the financial reports.

This accuracy is crucial for maintaining financial transparency, which is essential for building trust with stakeholders, including investors, regulators, and customers.

Accurate financial reporting provides a clear picture of the company’s financial health, allowing stakeholders to make informed decisions.

Furthermore, financial transparency is a key factor in securing investment, obtaining financing, and maintaining a positive reputation in the market.

Visual analytics can play a pivotal role in enhancing financial transparency. By providing clear, easily interpretable visual representations of complex financial data, visual analytics make it easier for stakeholders to understand the company’s financial position, performance, and risks.

For example, visual tools such as dashboards, charts, and graphs can help stakeholders quickly grasp key metrics, such as revenue growth, profit margins, and currency exposure, without needing to delve into detailed financial statements.

- Simplifying Global Operations with Accessible Data

Managing a global business is no small feat, especially when it comes to financial operations. Multi-currency reporting simplifies these operations by providing accessible, standardized data across all regions.

When financial data is presented in a consistent and standardized format, it becomes easier to analyze, compare, and interpret, regardless of the currency involved.

Accessible data is particularly important for decision-makers who need to act quickly based on accurate information.

For instance, a company’s CFO might need to assess the financial impact of currency fluctuations on the company’s profitability in real-time.

With accessible, real-time data, the CFO can quickly analyze the situation and make informed decisions, such as hedging against currency risk or adjusting pricing strategies in different markets.

Data visualization techniques can further enhance the accessibility of financial data. By presenting data in a visual format, such as charts, graphs, or heat maps, complex information becomes easier to understand and interpret.

This not only improves decision-making but also ensures that financial data is accessible to all stakeholders, including those who may not have a financial background.

- Strategic Decision-Making Across Markets

Multi-currency reporting is not just about compliance and accuracy; it also plays a crucial role in strategic decision-making.

For businesses operating in multiple markets, understanding the financial performance of each region is key to making informed decisions about resource allocation, pricing, and investment.

For example, a business may need to decide whether to expand operations in a particular region. By analyzing multi-currency financial reports, the company can assess the profitability of that region, taking into account factors such as currency fluctuations, local operating costs, and revenue potential. This analysis enables the company to make strategic decisions that maximize profitability and minimize risk.

Visual analytics supports this decision-making process by providing a clear, visual representation of financial data. For example, a heat map might be used to show revenue growth by region, highlighting areas with the highest and lowest growth rates. This visual representation makes it easier for decision-makers to identify trends, spot opportunities, and address potential issues.

Moreover, multi-currency reporting can help businesses manage currency risk, which is a significant concern for companies operating in international markets.

By analyzing currency exposure and its impact on profitability, businesses can implement hedging strategies to protect against adverse currency movements.

This proactive approach to risk management is essential for maintaining financial stability and achieving long-term success in global markets.

Implementing Multi-Currency Reporting in Your Business

Choosing the Right Tools for Multi-Currency Reporting

Implementing multi-currency reporting in your business starts with choosing the right tools. The software you select should support multi-currency transactions, provide real-time data updates, and offer robust visual analytics and data visualization features.

These tools should also integrate seamlessly with your existing financial systems, ensuring a smooth transition and minimal disruption to your operations.

When evaluating multi-currency reporting tools, consider the following factors:

- Scalability: The tool should be scalable to accommodate your business’s growth. As your company expands into new markets, the reporting system should be able to handle an increasing number of currencies and transactions.

- User-Friendliness: The tool should be easy to use, with an intuitive interface that allows users to generate reports, analyze data, and visualize information without extensive training.

- Customization: Look for tools that offer customization options, allowing you to tailor reports to your specific needs. For example, you may want to customize reports by region, currency, or product line.

- Integration: Ensure that the tool can integrate with your existing financial systems, such as accounting software, ERP systems, and CRM platforms. This integration is crucial for streamlining data flow and ensuring that all financial information is up-to-date and accurate.

- Compliance: The tool should support compliance with international financial reporting standards, such as IFRS or GAAP. This is particularly important for businesses that operate in multiple jurisdictions and need to meet regulatory requirements.

Best Practices for Effective Multi-Currency Reporting

To ensure effective multi-currency reporting, it’s essential to follow best practices. These include:

#1 Regularly Updating Exchange Rates: Exchange rates can fluctuate significantly, impacting the accuracy of your financial reports.

To ensure that your reports reflect the most current market conditions, it’s important to regularly update exchange rates.

Many multi-currency reporting tools offer automatic updates of exchange rates, ensuring that your financial data is always accurate.

#2 Standardizing Reporting Formats: Consistency is key when it comes to multi-currency reporting. Standardizing reporting formats across all regions and currencies makes it easier to compare data and generate consolidated reports.

This standardization also helps to ensure that all stakeholders, regardless of their location, receive consistent and accurate financial information.

#3 Automating Reporting Processes: Automation is a powerful tool for improving the accuracy and efficiency of multi-currency reporting.

By automating the data collection, conversion, and reporting processes, businesses can reduce the risk of human error and ensure that reports are generated quickly and accurately.

Automation also frees up valuable time for finance teams, allowing them to focus on more strategic tasks.

#4 Training Staff: To get the most out of your multi-currency reporting tools, it’s important to ensure that your staff are properly trained.

This includes not only the finance team but also other stakeholders who may need to access and interpret financial reports.

Providing training on how to use the tools, generate reports, and understand data visualizations can help to improve the overall effectiveness of your multi-currency reporting system.

#5 Regularly Reviewing and Auditing Reports: Regular reviews and audits of your multi-currency reports are essential for ensuring accuracy and compliance.

This process helps to identify any discrepancies, errors, or areas for improvement in your reporting system.

It also ensures that your financial reports remain consistent with international standards and reflect the true financial position of your business.

Common Challenges and How to Overcome Them

Despite the many benefits of multi-currency reporting, implementing it can present several challenges. Some of the most common challenges include:

Exchange Rate Volatility:

Exchange rate fluctuations can have a significant impact on the accuracy of multi-currency reports. To overcome this challenge, businesses should regularly update exchange rates and consider using forward contracts or other hedging strategies to mitigate the impact of currency fluctuations.

Data Inconsistency: Managing financial data from multiple regions and currencies can lead to inconsistencies, especially if different regions use different accounting practices or reporting standards.

To address this challenge, businesses should standardize their reporting formats and ensure that all regions follow the same accounting principles.

Complexity of Consolidation: Consolidating financial data from different regions and currencies can be a complex and time-consuming process.

To simplify this process, businesses should use automated tools that can quickly and accurately consolidate data into a single report. These tools should also support real-time data updates, ensuring that the consolidated reports reflect the most current financial information.

Compliance with Multiple Regulatory Standards: Businesses operating in multiple jurisdictions may need to comply with different regulatory standards, such as IFRS, GAAP, or local accounting standards.

To ensure compliance, businesses should choose multi-currency reporting tools that support multiple regulatory frameworks and provide customization options for different jurisdictions.

Resistance to Change: Implementing a new multi-currency reporting system may be met with resistance from staff who are accustomed to the old system.

To overcome this challenge, businesses should provide training and support to help staff transition to the new system. It’s also important to communicate the benefits of the new system, such as improved accuracy, efficiency, and strategic decision-making.

Visual Analytics and Data Visualization Techniques in Multi-Currency Reporting

The Power of Visual Analytics in Financial Reporting

Visual analytics can greatly enhance financial reporting by simplifying complex data. By presenting financial information in a visual format, such as charts, graphs, and dashboards, businesses can quickly and easily interpret the data, identify trends, and make informed decisions.

For example, a dashboard that displays key financial metrics, such as revenue growth, profit margins, and currency exposure, can provide a quick overview of the company’s financial performance across different regions. This visual representation makes it easier for decision-makers to understand the company’s financial position and identify areas for improvement.

Visual analytics also play a crucial role in communicating financial information to stakeholders. By presenting data in a clear and visually appealing format, businesses can ensure that stakeholders, including investors, regulators, and board members, can easily understand the company’s financial performance and make informed decisions.

Data Visualization Techniques for Multi-Currency Reporting

When it comes to multi-currency reporting, certain data visualization techniques are particularly effective. These techniques include:

Heat Maps: Heat maps are an excellent tool for comparing financial performance across different regions or currencies. By using color-coded scales, heat maps can quickly highlight areas of strong and weak performance, making it easier for decision-makers to identify trends and take action.

Bar Charts: Bar charts are useful for comparing financial metrics, such as revenue, expenses, and profits, across different currencies or regions. By visualizing the data in a bar chart, businesses can easily compare performance and identify any discrepancies or areas for improvement.

Pie Charts: Pie charts are effective for visualizing the distribution of financial metrics, such as revenue or expenses, across different regions or currencies. By breaking down the data into segments, pie charts can provide a clear overview of how financial metrics are distributed across the business.

Line Graphs: Line graphs are ideal for tracking financial performance over time. By plotting financial metrics, such as revenue or profit margins, against time, businesses can identify trends, track progress, and make informed decisions.

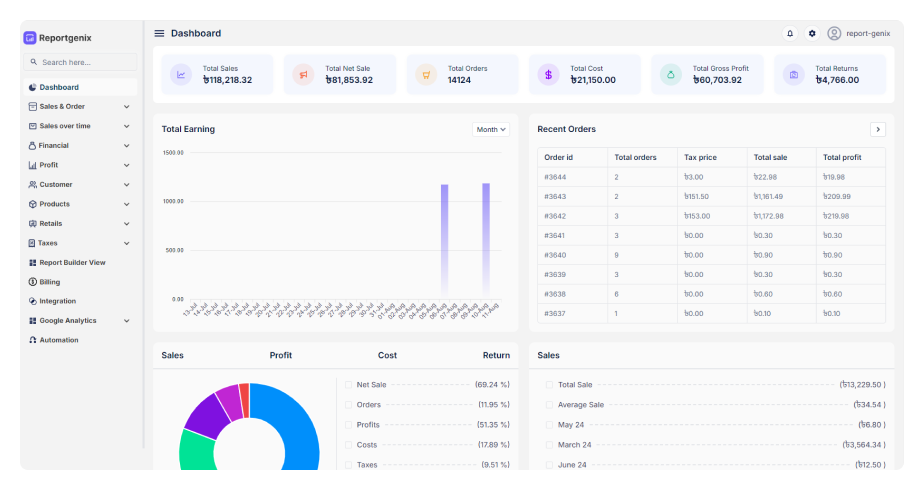

Dashboards: Dashboards are a powerful tool for visualizing multiple financial metrics in a single view. By consolidating data from different sources and presenting it in a visual format, dashboards provide a comprehensive overview of the company’s financial performance.

This makes it easier for decision-makers to monitor performance, identify trends, and make informed decisions.

Making Data Accessible to Stakeholders

One of the key goals of data visualization is to make financial data accessible to all stakeholders, including those who may not have a financial background. By presenting data in a clear, concise, and visually appealing format, businesses can ensure that all stakeholders can easily understand and interpret the financial information.

For example, a well-designed dashboard can provide a quick overview of the company’s financial performance, allowing stakeholders to grasp key metrics without needing to delve into detailed financial statements. This not only improves decision-making but also enhances communication and transparency within the organization.

Moreover, making data accessible to stakeholders is essential for building trust and ensuring that everyone is on the same page. By providing clear and accurate financial reports, businesses can foster a culture of transparency and accountability, which is crucial for long-term success.

Case Studies: Success Stories of Businesses Using Multi-Currency Reporting

Case Study 1: Global Retailer Optimizes Operations with Multi-Currency Reporting

A global retailer operating in multiple regions faced significant challenges in managing its financial data across different currencies. The company’s existing reporting system was unable to handle the complexity of multi-currency transactions, leading to discrepancies, delays, and inaccurate financial reports.

To address these challenges, the retailer implemented a multi-currency reporting system that integrated with its existing financial systems and provided real-time data updates. The new system allowed the company to accurately record and consolidate financial transactions in different currencies, ensuring that all reports reflected the most current exchange rates.

In addition, the retailer leveraged visual analytics to enhance the accessibility and transparency of its financial reports. By presenting financial data in a visual format, such as dashboards and charts, the company was able to provide stakeholders with a clear overview of its financial performance across different regions.

The implementation of the multi-currency reporting system resulted in significant improvements in financial accuracy, transparency, and operational efficiency. The company was able to make more informed decisions, optimize its global operations, and ultimately achieve greater success in the international market.

Case Study 2: Financial Institution Enhances Decision-Making with Accessible Data

A financial institution operating in multiple countries needed a robust multi-currency reporting system to manage its financial data and support strategic decision-making. The institution faced challenges in consolidating financial data from different regions, managing exchange rate fluctuations, and ensuring compliance with international financial reporting standards.

The institution implemented a multi-currency reporting system that provided real-time data updates, automated the currency conversion process, and supported compliance with multiple regulatory frameworks. The new system also offered advanced data visualization features, allowing the institution to present complex financial data in a clear and accessible format.

With the new system in place, the institution was able to improve the accuracy and consistency of its financial reports, reduce the risk of currency exposure, and make more informed decisions. The use of visual analytics also enhanced communication with stakeholders, ensuring that all parties had a clear understanding of the institution’s financial position and performance.

The successful implementation of the multi-currency reporting system enabled the institution to achieve greater financial stability, improve its decision-making processes, and strengthen its position in the global market.

Reportgenix: Simplifying Multi-Currency Reporting

For businesses navigating the complexities of global operations, Reportgenix offers a robust solution with its multi-currency reporting feature. This advanced analytics platform streamlines the process of managing financial transactions across multiple currencies, allowing businesses to record, convert, and report on financial data with ease. Reportgenix automatically updates exchange rates in real-time, ensuring that all financial reports reflect the most current market conditions. Additionally, with customizable reporting options and powerful data visualization tools, Reportgenix makes it easier for businesses to consolidate financial data, comply with international standards, and make informed decisions across global markets. Whether you’re managing revenue from different countries or assessing the impact of currency fluctuations, Reportgenix empowers you to maintain financial accuracy and transparency in a globalized business environment.

The Future of Multi-Currency Reporting in Global Business

As global business operations continue to expand, the need for multi-currency reporting will only grow. The future of multi-currency reporting lies in the integration of advanced technologies, such as AI-driven analytics, machine learning, and blockchain, which will further enhance the accuracy, transparency, and accessibility of financial reporting.

AI-driven analytics, for example, can automate the process of currency conversion, data consolidation, and report generation, reducing the risk of human error and improving the efficiency of multi-currency reporting. Machine learning algorithms can analyze historical data to predict currency trends, helping businesses to manage currency risk and make more informed decisions. Blockchain technology can provide a secure and transparent platform for recording and verifying financial transactions, ensuring that all data is accurate and tamper-proof.

Final Thoughts

For businesses looking to thrive in a global market, implementing multi-currency reporting is not just an option—it’s a necessity. By leveraging the right tools, following best practices, and utilizing effective visual analytics, businesses can ensure that they are well-positioned to succeed in an increasingly complex and competitive global landscape.

Multi-currency reporting provides the foundation for accurate financial management, strategic decision-making, and compliance with international standards. It enables businesses to operate confidently across multiple regions, manage currency risks, and optimize their global operations. As technology continues to advance, multi-currency reporting will become even more powerful, providing businesses with the insights they need to achieve long-term success in the global market.

FAQs

What is multi-currency reporting and why is it important?

Multi-currency reporting refers to the process of consolidating financial data from transactions conducted in various currencies into a single reporting framework. This is crucial for businesses operating internationally, as it enables accurate financial analysis, compliance with local regulations, and better strategic decision-making. It helps stakeholders understand financial performance across different markets and ensures consistency in financial reporting.

How can visual analytics improve multi-currency reporting?

Visual analytics enhances multi-currency reporting by transforming complex financial data into intuitive visual formats, such as charts and graphs. This makes it easier to identify trends, patterns, and anomalies in multi-currency transactions. Visual tools can also simplify the comparison of financial performance across different currencies, enabling quicker insights and more informed decision-making.

What are the best practices for accurate multi-currency reporting?

Consistent Currency Conversion: Use reliable and up-to-date exchange rates for conversion.

Standardized Reporting Framework: Implement a standardized reporting format to ensure uniformity across different currencies.

Regular Reconciliation: Regularly reconcile multi-currency accounts to identify discrepancies early.

Automation Tools: Leverage financial software that supports multi-currency functionality to reduce manual errors.

Clear Documentation: Maintain clear documentation of currency transactions, conversions, and adjustments for transparency.1

Which data visualization techniques are most effective for multi-currency data?

Heat Maps: Useful for displaying currency performance across different regions.

Bar Charts: Effective for comparing total revenues or expenses in various currencies.

Line Graphs: Ideal for showing trends over time, such as exchange rate fluctuations.

Pie Charts: Helpful for illustrating the proportion of revenues or expenses by currency.

Dashboards: Comprehensive dashboards can combine various visualization techniques for an at-a-glance overview of multi-currency performance.

How does multi-currency reporting benefit global businesses?

Multi-currency reporting offers several benefits to global businesses, including:

1. Enhanced Financial Insight: It provides a clearer understanding of profitability in different markets.

2. Improved Decision-Making: Accurate data allows for better strategic planning and investment decisions.

3. Compliance and Risk Management: It helps ensure compliance with international financial regulations and assists in managing currency risk.

4. Optimized Resource Allocation: Businesses can allocate resources more effectively based on performance insights across various currencies.